Version Control Systems Market Growth, Trends and Forecast 2033

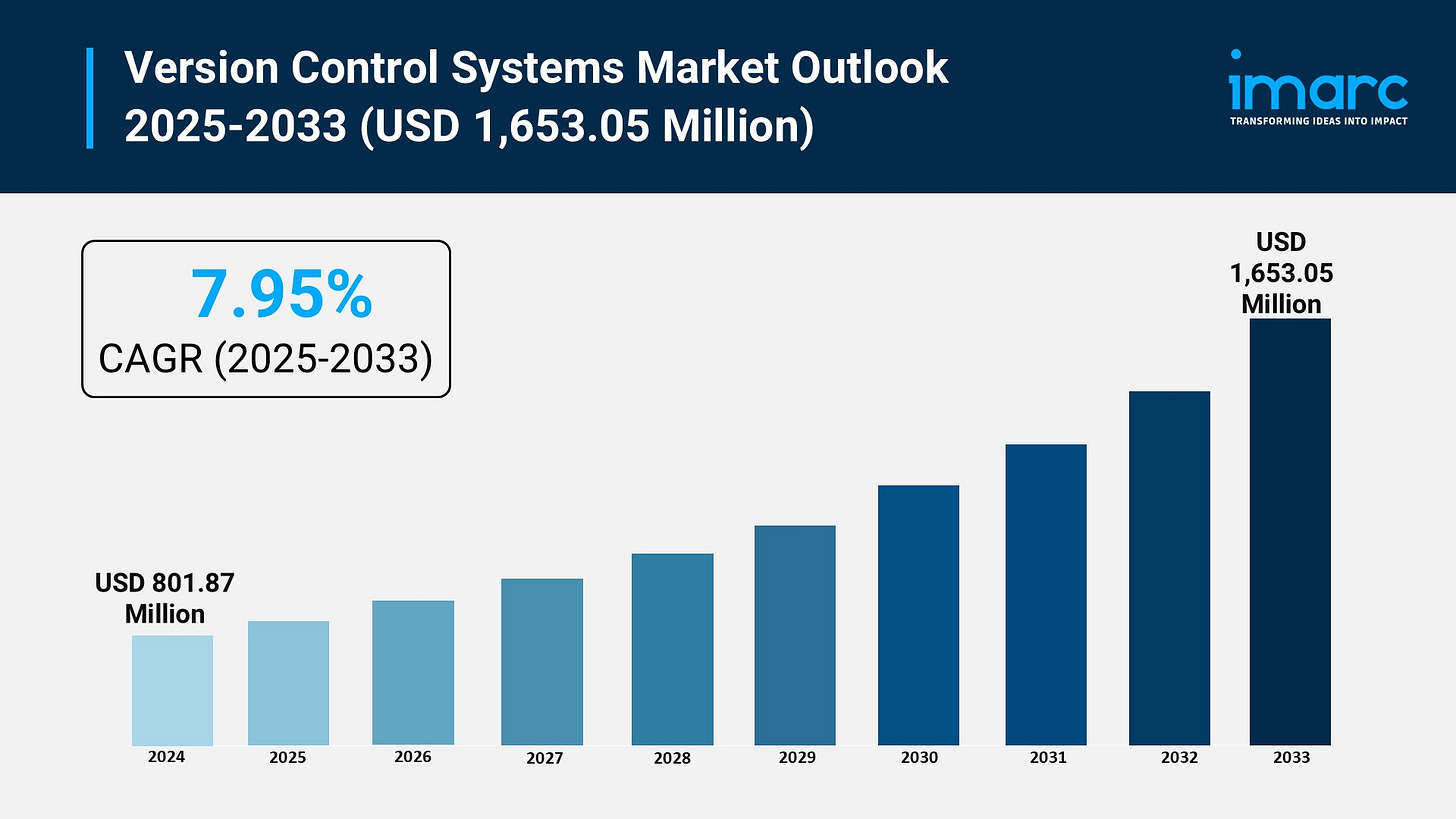

The global version control systems market size was valued at USD 801.87 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,653.05 Million by 2033.

Market Overview:

According to IMARC Group’s latest research publication, “Version Control Systems Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033“, offers a comprehensive analysis of the industry, which comprises insights on the global version control systems market share. The global market size reached USD 801.87 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,653.05 Million by 2033, exhibiting a growth rate (CAGR) of 7.95% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

How AI is Reshaping the Future of Version Control Systems Market

AI-powered version control tools enhance developer productivity by automatically resolving merge conflicts with intelligent suggestions, reducing manual intervention by 25-30%.

Machine learning models analyze historical commits to detect risky changes and suggest improvements before code is merged, with 30% of organizations now focusing on AI-powered VCS solutions.

GitHub Copilot and similar AI tools help developers automatically generate meaningful commit messages and code summarization, reducing developer workload by up to 20%.

AI-driven DevOps tools enable self-healing systems that detect and remediate issues autonomously, with 75% of global software development teams fully adopting methodologies requiring enhanced VCS capabilities.

Predictive analytics powered by AI can forecast system failures and performance bottlenecks, allowing teams to address concerns proactively and improve code quality by 15-20%.

Ask analyst of customized report: https://www.imarcgroup.com/version-control-systems-market/requestsample

Key Trends in the Version Control Systems Market

Cloud-Based VCS Platform Expansion: Organizations are rapidly migrating to cloud-based version control services like GitHub and Bitbucket to avoid infrastructure maintenance costs. Over 70% of IT enterprises now use cloud-based version control systems, with the EMEA public cloud services market estimated to reach USD 415.1 billion in 2028 at a CAGR of 20.0%.

GitOps and Infrastructure-as-Code Revolution: GitOps is becoming a core component of modern DevOps practices, using Git repositories as the single source of truth for infrastructure definitions. Version control systems leverage this methodology to track changes, roll back updates, and ensure consistency across environments, supporting the DevOps market expected to reach USD 38,453.1 million by 2030.

Enhanced Collaboration for Distributed Teams: Remote work trends drive demand for scalable VCS solutions that enable global collaboration. Approximately 90% of tech startups rely on version control systems as essential development tools, with 72% of developers believing VCS helps reduce development time by up to 30%.

Integration with Development Ecosystem: VCS platforms increasingly integrate with IDEs, CI/CD systems, project management platforms, and issue-tracking systems. Companies continue innovating with database DevOps portfolio updates for cross-database development, with 60% of organizations citing version control as a key factor in enabling collaborations.

Open-Source Software Development Growth: The surge in open-source projects boosts demand for collaborative version control solutions. Over 45% of open-source projects use distributed VCS tools, with Git’s usage rising from 87.1% in 2016 to 93.87% in 2025, reflecting the market’s shift toward decentralized and cloud-integrated solutions.

Growth Factors in the Version Control Systems Market

Widespread Adoption of DevOps and Agile Methodologies: A Gartner survey indicates that 75% of global software development teams are fully adopting Agile methodologies in 2024, driving increased VCS adoption for better code management. With 60% of enterprises adopting DevOps and Agile development, Git-based platforms are preferred for their flexibility and scalability.

Rise of Distributed Development Teams: Remote and hybrid work models have become standard practice, creating high demand for VCS solutions that operate from the cloud. Cloud-based infrastructure enables teams to collaborate regardless of location, eliminating requirements for on-site infrastructure and supporting continuous workflow integration.

Increasing Software Development Complexity: The growing complexity of software projects drives 40% of large enterprises to integrate automated version control systems to streamline code management and reduce deployment errors. Version control systems are essential for managing large-scale, distributed systems and microservices architectures.

Enhanced Security and Compliance Requirements: Organizations are prioritizing security through DevSecOps practices, with 37% of organizations extensively incorporating security into their DevOps processes and 33% doing so on a limited basis. VCS platforms now embed security scanning, SAST, DAST, and role-based access controls.

Scalability and Cost-Effectiveness: Cloud-based version control systems provide startups and enterprises with reduced infrastructure expenses and automated update capabilities. Subscription models eliminate on-premise hardware costs and streamline global collaboration, making VCS adoption more accessible across organization sizes.

Leading Companies Operating in the Global Version Control Systems Industry:

Amazon Web Services, Inc.

Atlassian Corporation Plc

GitHub Inc. (Microsoft Corporation)

GitLab Inc.

Perforce Software Inc.

Unity Software Inc.

Micro Focus International plc

IBM Corporation

Beanstalk (Wildbit, LLC)

WANdisco plc

CollabNet VersionOne

PTC Inc.

Version Control Systems Market Report Segmentation:

Breakup By Type:

Centralized Version Control Systems (CVCS)

Distributed Version Control Systems (DVCS)

Centralized version control systems (CVCS) represented the largest segment due to their built-in command and organization features, higher security levels, and reduced learning curve for organizations.

Breakup By Deployment Type:

On-Premises

Cloud

On-premises deployment dominates with around 55.8% market share, driven by data security concerns, compliance requirements, and customization needs in regulated industries.

Breakup By Enterprise Size:

Small and Medium Enterprises (SMEs)

Large Enterprises

Large enterprises lead the market with around 67.8% market share, due to their geographically distributed teams, complex codebases, and multiple parallel projects requiring robust VCS solutions.

Breakup By End Use:

IT and Telecom

BFSI

Healthcare and Life Sciences

Retail and E-commerce

Manufacturing

Education

Others

IT and telecom account for the largest market share due to increasing software project complexity, demand for seamless team collaboration, and drive for shorter release cycles.

Breakup By Region:

North America (United States, Canada)

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa

North America enjoys the leading position with over 35.0% market share, driven by strong IT sector growth, high innovation rates, and the presence of major tech companies and startups.

Recent News and Developments in Version Control Systems Market

May 2025: Microsoft introduced a GitHub AI agent capable of autonomous coding tasks, available to Copilot Pro+ and Enterprise subscribers, significantly enhancing AI-powered development workflows.

March 2025: Perforce completed its P4 platform rebrand, consolidating DevOps tools and launching P4 One for designer workflows, optimized for artists and designers eliminating Git LFS bottlenecks.

March 2024: GitLab acquired Oxeye, a cloud security testing software platform, strengthening its DevSecOps capabilities and security scanning features integrated into the CI/CD pipeline.

February 2025: Sourcepoint launched Legal Preferences and Transaction Receipts features within its Universal Consent & Preferences platform, providing version control for legal policies with regional customization and comprehensive audit trails.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

Wow, the part about AI in version controll really stood out to me. This article is so insightful about the future. I wonder how it will shape the learning curve for new developers.